Navigating To Retirement Success:

The Aviation Professionals Investment Advisor of Choice

Weiser Financial Group is a retirement-focused investment advisor with over 16 years of experience in pension plans, profit sharing plans, 401(k) management, 401(k) rollovers, and scheduled distributions design. Our commitment is to meet the unique needs of both current and retiring aviation professionals.

Getting started is easy – schedule a free, confidential, no sales pressure call to begin.

Extensive Experience

With over 16 years of experience as an investment advisor, Weiser Financial Group specializes in providing retirement solutions tailored to aviation professionals. Dan brings a distinctive blend of expertise gained as a retired B-767 Captain, 401(k) plan trustee, and investment advisor to the firm. Having acquired a comprehensive understanding of the financial challenges and opportunities faced by aviation professionals over the past 30 years, he is ready to leverage that knowledge to benefit you.

Retirement Focus

We are dedicated to assisting aviation professionals in developing secure retirement strategies. Our knowledge in pension plans, profit sharing plans, 401(k) rollovers, and establishing systematic withdrawals distinguishes us in this field.

Personalized Strategies

Our approach is highly personalized because we recognize that one size doesn't fit all retirees. We are committed to tailoring investment strategies to align precisely with your unique financial goals, risk tolerance, and time horizon, all at a competitive price—perhaps even less than you are paying right now. Importantly, we do not have any hidden fees.

Value-Added

Discover more about the value we add to your portfolio:

Our firms "Value-added" denotes the additional value or benefit that a product, service, or process offers to clients beyond their usual expectations. It encompasses the extra enhancements, features, or improvements that set a product or service apart from others in the market, enhancing its appeal and worth to end-users. Value-added elements may encompass aspects like enhanced functionality, superior quality, cost-efficiency, and convenience.

A Retirement Flight Plan

Consider us your financial "Navigator." We plot your financial course, estimate your savings journey's duration, and make automatic adjustments, much like an experienced pilot. Our objective is to ensure you reach your financial destination securely and content.

Why Clients Trust Us

Our clients trust us because they have seen our honesty and transparency as an investment advisor and in the cockpit. Dan is a Registered Financial Consultant®, holds a Series 65 Securities License, and has over a decade of experience as a airlines 401(k) trustee and airlines retirement committee chair.

Diversified Portfolios

We provide a choice of 40 globally diversified portfolios managed by Financial Engines Advisors, our Sub-Advisor. Each portfolio is scientifically crafted with up to 22 holdings. Financial Engines Advisors continually monitors all portfolios for daily rebalancing opportunities and automatically rebalances them at no additional cost.

Competitive Fees

Our all-inclusive fees are exceptionally competitive. For a $1.5M portfolio, the management fee is approximately 1.1%, with the percentage decreasing as your account size grows. We maintain full transparency, with no concealed fees, and we do not utilize "funds of funds," a method often employed by 401(k) sponsors and other advisors to obscure the true portfolio expenses. We take pride in being the home of transparent, no hidden fees services.

Our Business Model

As an independently licensed investment advisory firm, we have an alliance with Financial Engines Advisors (formerly known as Edelman Financial Engines) and use Charles Schwab as our custodian. We serve clients coast-to-coast in 12 states, focusing on helping airline crew members transitioning their 401(k)s into Rollover IRAs.

Guiding Principles

At Weiser Financial Group, we prioritize goals and strategic planning over market speculation. Successful investing is goal-focused, not driven by current events.

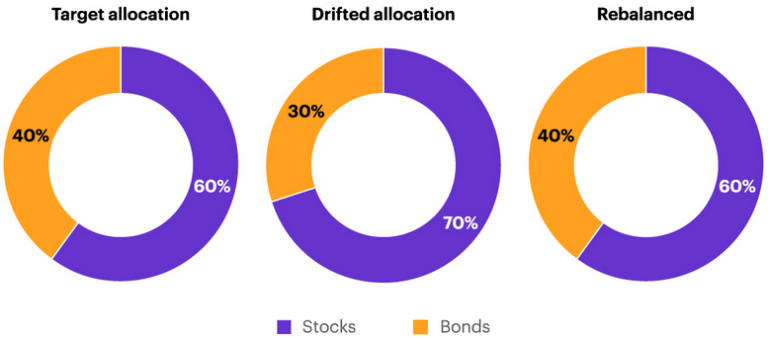

About Rebalancing

Portfolio rebalancing is a crucial risk-management strategy. It involves selling assets that have appreciated and now make up a larger portion of your portfolio while acquiring assets that are currently less popular. Essentially, it means selling your successful investments and purchasing those with growth potential, adhering to the principle of buying low and selling high.

Additionally, rebalancing has the potential to enhance your portfolio's performance. This practice is widely recognized in the financial industry. Notably, Financial Engines Advisors distinguishes itself as the only major firm that consistently monitors portfolios on a daily basis, (not quarterly or annually) a tradition they've upheld for over 25 years.

©2008-2024 Copyright Weiser Financial Group. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details and accept the service to view the translations.